فهم ديناميكيات منحنى العائد وتطبيقات السوق

Udemy Review

الموقع

Online(رابط الدورة)

التاريخ

عند الطلب

أقسام الدورات

تجارة و إدارة

الشهادة

Yes(Certificate of completion)

اللغة

الإنجليزية

رسوم الدورة

(التحقق من صفحة الدورة لآخر سعر) 742.58 دولار أمريكيعدد الحضور

غير محدود

المهارات المكتسبة

- Understand how yield curves depict fixed income instrument pricing and risk premiums

- Explain duration as a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates

- Describe the different types of duration, and how each is used in managing and/or quantifying risk

| اسم مقدم الدورة | Udemy |

|---|---|

| مجالات التدريب |

|

| موقعك الإلكتروني (URL) | www.udemy.com |

| حول المزود |

Udemy.com is an online learning platform aimed at

professional adults and students. Udemy,

a portmanteau of you + academy, has more than 30 million students and 50,000

instructors teaching courses in over 60 languages. There have been over 245

million course enrollments. Students and instructors come from 190+ countries

and 2/3 of students are located outside of the U.S. Udemy also has over 4,000

enterprise customers and 80% of Fortune 100 companies use Udemy for employee

upskilling (Udemy for Business). Students take courses largely as a means of

improving job-related skills.Some courses generate credit toward technical certification. Udemy has

made a special effort to attract corporate trainers seeking to create

coursework for employees of their company. Udemy

serves as a platform that allows instructors to build online courses on topics

of their choosing. Using Udemy's course development tools they can upload

video, PowerPoint presentations, PDFs, audio, zip files and live

classes to create courses.[citation needed] Instructors can

also engage and interact with users via online discussion boards. Courses

are offered across a breadth of categories, including business and entrepreneurship,

academics, the arts, health and fitness, language, music, and technology. Most

classes are in practical subjects such as Excel software or

using an iPhone camera. Udemy also offers

Udemy for Business, enabling businesses access to a targeted suite of over

3,000 training courses on topics from digital marketing tactics to office

productivity, design, management, programming,

and more. With Udemy for Business, organizations can also create custom

learning portals for corporate training. |

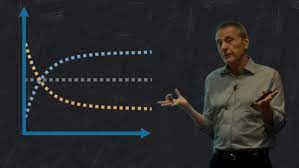

In the finance business, a yield curve is used to visually display the current conditions of the market, and specifically some particular fixed income product (such as a corporate bond, or government note). The yield curve is a snapshot of interest rates in that market at a point in time, plotting the “yield to maturity” on the vertical axis and the “time to maturity” on the horizontal axis. A yield curve also is sometimes referred to as “the term structure of interest rates.”

Simply put, if you are involved in the financial markets on any level (as an investor, analyst, salesperson, banker, advisor, or trader) you must understand what yield curves are, how they work (with changes in economic conditions, market movements, government policy, etc.), and you must be able to explain these curves to lay-people (including your colleagues and clients).

In this course, we dive deep into yield curves, although we start out with the basics:

What is a yield curve and how is it “constructed?

Why do yield curves matter?

What is “duration” and how does that impact the shape of the curve?

How is duration used in financial and market analysis

What are “spot” and “forward” rates

What is “total return analysis?”

If you want to “look smart” and BE smart in the investment management, investment banking, investor advisory and other related financial fields, this course is a MUST, not merely “optional.”