Asset allocation in investment

OpenLearn Review

Location

Online(Course Link)

Dates

On Demand

Course Categories

Business and Management

Certficate

Yes(statement of participation)

Language

English

Course Fees

FreeNo. of Attendant

Unlimited

Acquired Skills/Covered Subjects

- recognise how typical client objectives and constraints impacts on asset allocation,set client risk and return objectives in the context of an asset allocation process,describe the reasons for a written investment policy statement and its major components,recognise typical client objectives and constraints and how these impact on portfolio choice

| Provider Name | OpenLearn |

|---|---|

| Training Areas |

|

| Website | http://www.openuniversity.edu/ |

| About The Provider |

Since its launch in 2006, OpenLearn has become an integrated part of The Open University, with the site attracting more than 69 million visitors – many of which go on to make an enquiry about becoming a formal student, strengthening the journey between informal and formal learning. The OpenLearn team originate, commission and develop content that unites faculty and University priorities with areas of topical and general interest. This is in support of our own student population in their academic, skills and career and personal development (CPD) endeavours, delivering quality assets openly available for teaching and learning. OL deliver bite-sized learning experiences designed to fit easily into daily life, so whether you're a busy parent looking to get promoted at work, or back-packing across Africa and wanting to increase your learning, we are open with no requirements to access our free materials. Some of OL academic-led content includes: |

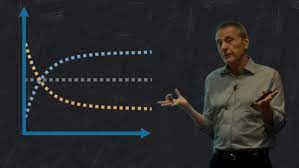

This course looks at how to take investor objectives and constraints and turn them into a portfolio which aims at achieving an expected return and level of risk appropriate for the investor. In this free course, Asset allocation in investment, portfolio optimisation techniques such as portfolio theory can be used to determine how much of an investor’s portfolio to put in each asset class. Portfolio theory can also be used to determine so-called model portfolios which offer optimised benchmarks for investors with the same objectives and constraints.